Why Property Can Transform Wealth and Lives

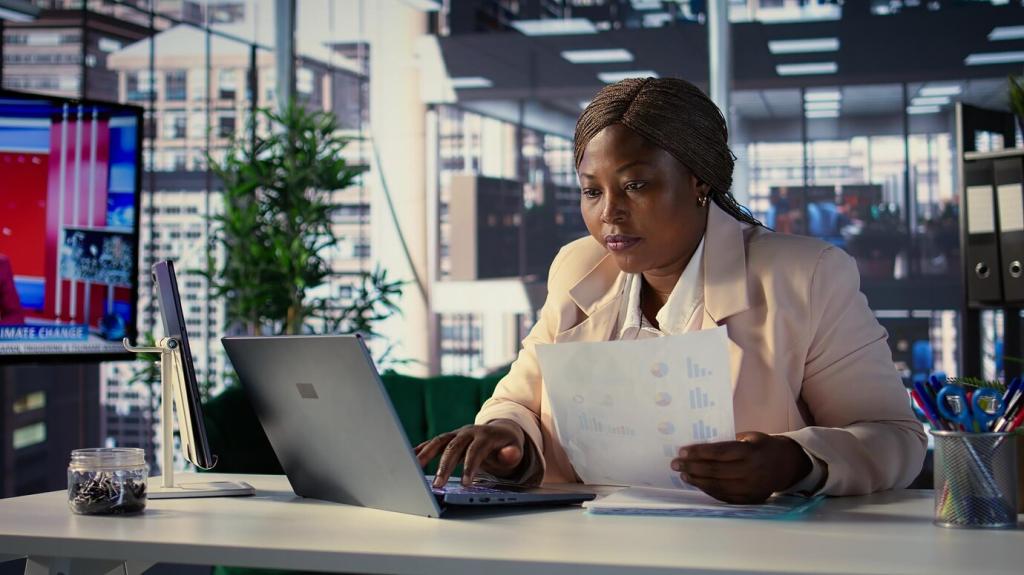

With responsible financing, a small down payment governs a large asset, allowing appreciation and improvements to compound your equity. When paired with conservative underwriting, leverage accelerates progress without gambling your future. Tell us how you balance ambition with prudence.

Why Property Can Transform Wealth and Lives

Unlike purely paper assets, property allows direct interventions: renovations, tenant experience, and operational refinement. These hands-on levers create measurable value. If you enjoy building, optimizing, and improving, real estate rewards initiative. Comment with one improvement you’d implement first.